Please enter the SFG homepage password for further access to this site. If you would like to request a password, please click here to contact us.

When you invest in the SFG Income Fund,

you invest in what we believe is the finest portfolio of first priority equity based loans on the West Coast. We simply have better properties securing our loans, better borrowers and better underwriting.

All SFG Loans are thoroughly analyzed for solid value and marketability. Our 30+ years spent building strategic relationships and intense market knowledge has provided us with quality choices, leading to superior portfolio resilience and performance.

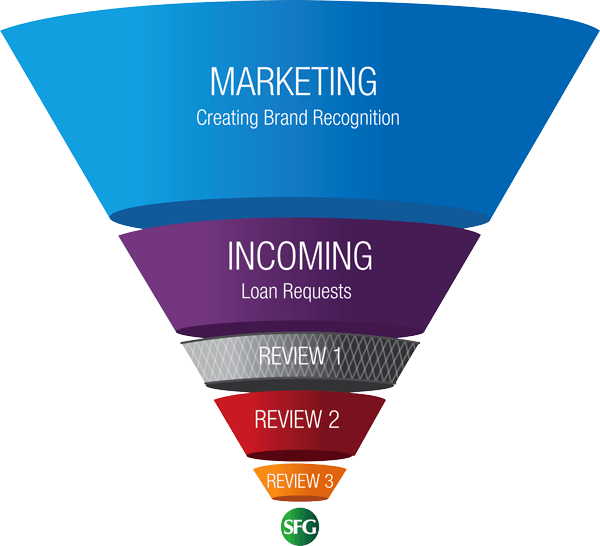

How does Seattle Funding Group obtain so many loan choices to filter from?

The answer: decades of consistent marketing, substantial brand recognition within the markets we serve, and proven performance, all leading to strategic relationships formed over many years. Today, our mortgage audience is deeper than ever before. Our competitive advantage strengthened. Our choices richer. As an industry leader in the private money real estate lending field, our platform to ensure enduring fund performance is at its best. Still, we invest time, effort and capital daily to maintain our market leadership position and to provide our underwriting team with a plethora of terrific choices to further vet. Our methods lead to superior portfolio performance for the SFG Income Funds.